Market Fundamentals Analysis

The past week has been an interesting one for cryptocurrencies assets. The market seems to have set a cyclical trend, creating a sense of uncertainty among investors and traders alike. Having said that, volumes have been able to sustain, and given the volatility that markets have been experiencing over the past two weeks or so, this is a positive sign, as it reflects a fundamentally strong outlook.

Bitcoin (BTC), the largest asset by market capitalization, leads this trend. After reaching highs of C$62,342 close to two weeks back, the asset tumbled, falling by close to 20% to C$54,900 levels. Post this fall, markets did offer some respite, and a recovery trend set in, however that was short lived. Last week saw yet another bloodbath for the asset, as it fell to a low of C$51,000 in September. BTC’s market capitalization currently stands at $900bn, which reflects a 42% dominance.

Fundamentally, two key reasons can be attributed to the volatility of the asset. Firstly, China has released a series of new rules and regulations with respect to the cryptocurrency ecosystem in the country, which led to miners and traders dumping their assets, leading to a sell off which hampered prices. Secondly, the widespread negative sentiments in the US stock markets after the FED indicated that monetary stimulus will be reduced, has also had an adverse impact on the space. This has historically been the case, and a positive correlation seems to be in place between equity and cryptocurrency markets. However, over the weekend, a recovery trend seems to have set in again.

Ethereum (ETH) has also witnessed a similar trend like Bitcoin. The asset, after touching a September high of C$5,049, fell by almost 32.5%, to a low of C$3,408. Since then, a slight recovery has set it, but not as large as that of BTC. The asset is up by 15% and currently trades at C$3,915. Volumes have shown good traction, as at current prices the asset does look fairly attractive. Institutional inflow into the asset has reduced, but given the glooming uncertainty and volatility currently, this is not a cause of concern. The battle between the bears and bulls continues, which is probably why ETH has been in a consolidating phase, over the past few days, trading in a range bound fashion, between C$3,500 and C$4,000. The asset faces a strong psychological resistance at C$4,050, which if the asset crosses, and sustains, is likely to witness another strong rally. The overall pessimistic views in the marketplace, has led to investors growing increasingly cautious, and many have chosen to book profits during the fall. Interestingly, ETH/BTC ratios also hit new lows for the month. China’s crackdown significantly impacted ETH, which fell by 14%, almost immediately after the news came in. BTC in comparison fell by 10%, as investors became increasingly pessimistic on the pair. Ether underperformed directly against Bitcoin, with the ETH/BTC pair falling to 0.066 BTC for the first time this month. At its yearly high, the pair traded at 0.079 BTC.

Cardano (ADA), has been on a rise this year, after it recently attained the 3rd position in terms of market capitalization. ADA has witnessed a similar trend this week, as it plunged from its 30 day high of C$3.876 to almost C$2.50. ADA has been in the news over the last quarter or so, as its much anticipated Alonzo hard fork was in the works. During this period, the asset recorded a 70% and 1200% increase over the last 90 and 180 days, respectively. The interview of Gary Gensler’s, U.S Securities and Exchange Commission (SEC) Chairman, might have had an impact on the prices of ADA this week. The asset has given up almost ⅓ of its value in just a few weeks. The fall is likely to see a reversal if BTC finds support and bounces back, provided it is supported by strong volumes and momentum. Recently the term “Ethereum Killer” has been trending in google search indicating that the asset has garnered a lot of interest in the community.

Ripple (XRP) has been witnessing a battle between the bulls and the bears. The trend the asset has been setting seems to suggest some indecisiveness among investors and traders alike. Having said that, volumes have been on the rise over the past few days, indicating that after falling about 12%, XRP seems to look quite attractive at current levels. The uncertainty resolved to the downside over the weekend as bears have pulled the price down to the 100-day SMA. If this support gives way, the selling could pick up momentum and the XRP/USDT pair could slide to C$0. 70, which would result in another manic panic. This level may act as a strong support but if bears do take control there on, the next stop could be C$0.65. On the other hand, a reversal seems to have set in over the weekend, and if that continues along with good volumes, then bulls could push XRP to C$1.15.

Market Updates:

- Salvadoran President Nayib Bukele claims that 2.1 million of his fellow citizens are using the government-backed Chivo cryptocurrency wallet, offering a glimpse into the apparent success of the country’s Bitcoin (BTC) gambit.

- Ukraine has passed laws that will ease the adoption of cryptocurrencies within the country.

- Bitcoin’s price tumbled after Chinese authorities reiterated their tough stance against cryptocurrency activities, including trading and mining.

- As the lawsuit with the U.S. Securities and Exchange Commission (SEC) continues, Ripple CEO Brad Garlinghouse insists that the Commission has provided no clarity in crypto regulation.

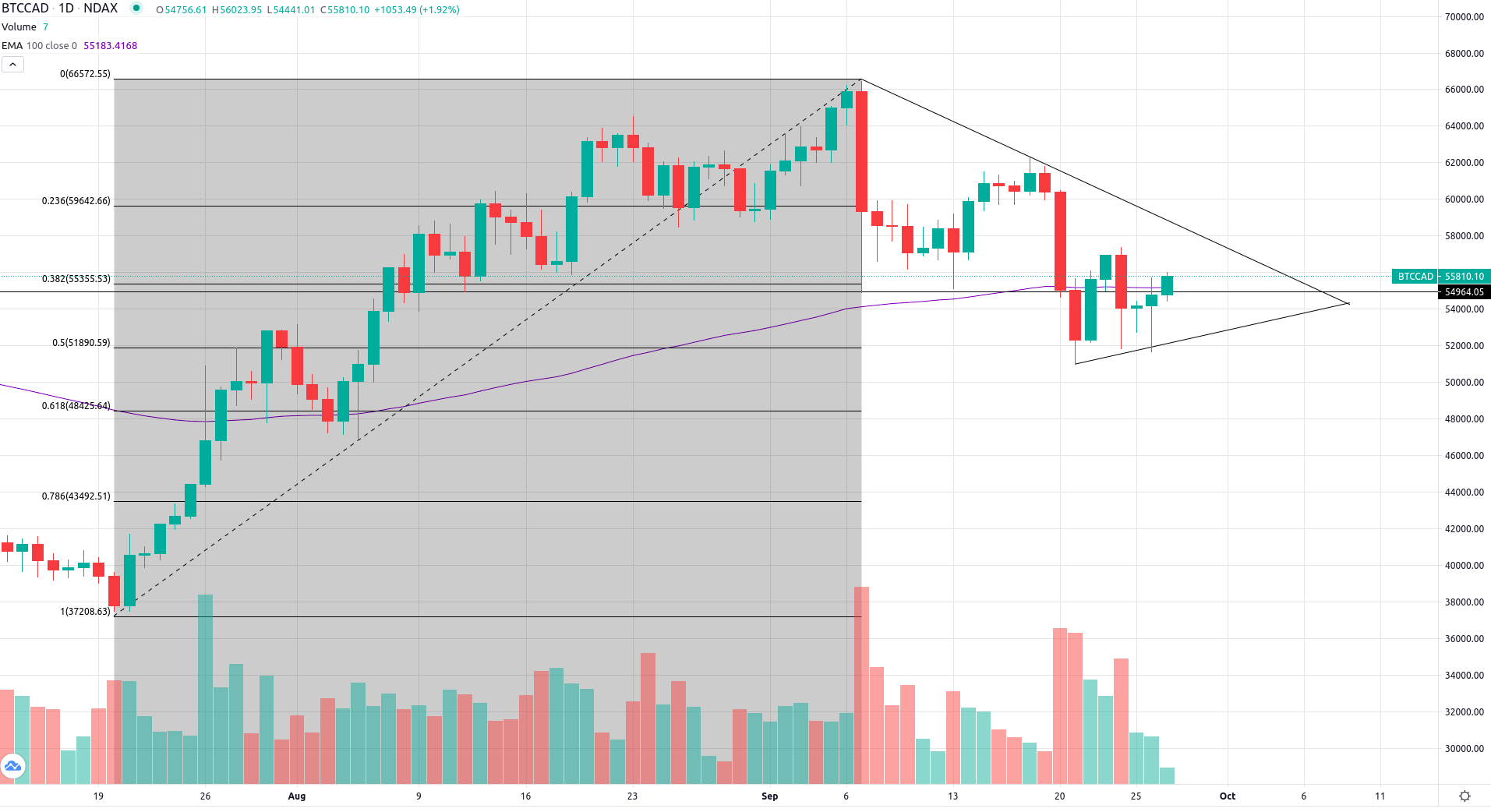

Bitcoin (BTC) Technical Analysis

Bitcoin last week, after making the low of C$51,000, showed signs of recovery and rallied almost by 12.5% up to C$57,384. The asset faced resistance around these levels and yet again witnessed sell off over the weekend. However, it did not test the recent lows and reversed from $51,688. Although BTC is trading in a downtrend, it has taken support around $51,890 (50% Fibonacci Retracement Level) and made a ‘Bullish Engulfing’ Pattern which is a two candle bullish reversal pattern occurring in a downtrend. If the bulls manage to hold the support, BTC might resume its up move and we can expect some relief rally. The asset has a strong resistance around C$57,500 to C$59,500, if the breakout occurs above these levels then the prices may rally up to the C$65k mark. On the contrary, a break or close below the recent low, and the bears will take the lead, and the prices could slide to C$48,500.

Key Levels:

| Resistance 2 | C$62,000.00 |

| Resistance 1 | C$57,500.00 |

| NDAX | BTC |

| Support 1 | C$51,000.00 |

| Support 2 | C$48,500.00 |

For the latest cryptocurrency prices, check out our live cryptocurrencies rates page!

Article provided by NDAX

Keep your crypto secure, everywhere!

The Ledger Wallet is the most advanced cryptocurrency wallet for securely holding and using cryptocurrencies. Keep your assets safe as they generate revenues. You can grow your crypto by staking your Tron, Cosmos, Tezos, Algorand or Polkadot directly in Ledger Live.

Install up to 100 crypto applications at the same time on your Ledger Nano X. More than 1500 cryptocurencies supported, including Bitcoin, Ethereum, Litecoin…

Learn more about the Ledger Nano » Official website

*Risk Disclosure: Cryptocurrencies are complex and are risky investments based on their highly speculative natures and the uncertainty of the market. They are not legal tender, nor are they supported by a government or central bank. The value of a cryptocurrency is entirely derived by international market forces, such as global supply and demand, and as such the value is volatile. Bitcoin & Cryptocurrency trading may not be suitable for all investors, please ensure that you fully understand the risks involved. Seek independent expert advice if necessary.

Disclaimer: Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.